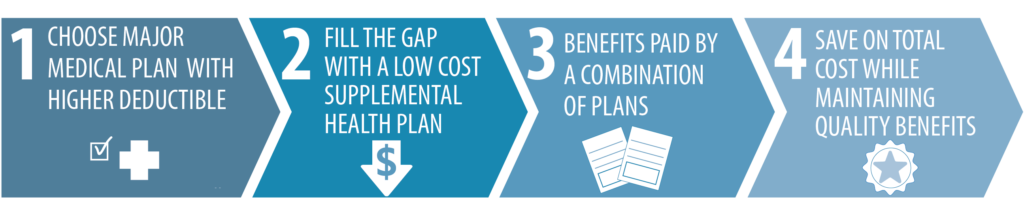

The high cost of major medical coverage is forcing individuals to shoulder an increasingly larger share of their medical costs through higher deductibles and larger co-pays in order to keep premiums in check. This new program, a Member Group Supplemental Health insurance Plan is a specially priced group plan for members, designed to help you pay for out-of-pocket living and healthcare expenses such as hospital stays, diagnostic tests, and more.

Ready to get started?

How it works.

A variety of plan options.

The Accident and Sickness Limited Benefit Cash Policy provided through the Texas Bar Private Insurance Exchange, is offered only to members of the State Bar of Texas and is not intended to be part of any employee welfare benefit plan.

Important Notice: The insurance provided under the Accident and Sickness Limited Benefit Cash Policy provides limited benefits. Benefits are supplemental and not intended to cover medical expenses. A Covered Person should maintain a separate comprehensive health insurance coverage plan. This policy does not provide Medicare Supplement Coverage. If a Covered Person is eligible for Medicare by reason of age, review the Guide to Health Insurance for People with Medicare available from Federal Insurance Company.

THIS IS A SUPPLEMENT TO HEALTH INSURANCE AND IS NOT A SUBSTITUTE FOR MAJOR MEDICAL COVERAGE. LACK OF MAJOR MEDICAL COVERAGE (OR OTHER MINIMUM ESSENTIAL COVERAGE) MAY RESULT IN AN ADDITIONAL PAYMENT WITH YOUR TAXES.

Insurance is underwritten by Federal Insurance Company, a member insurer of the Chubb Group of Insurance Companies. Actual coverage is subject to the language of the policy as issued. Exclusions Apply. Chubb, Box 1615, Warren, NJ 07061-1615.