The Texas Bar Private Insurance Exchange is available to members of the State Bar of Texas (as well as their spouses and employees), paralegals, and law students.

We offer a wide-range of health options from leading providers for you and your family. Everyone is different, and we know that it is important for you to have a variety of health plans to choose from so you can find what works for your lifestyle and financial picture.

Choose an option to start shopping for Individual Health Coverage:

Individual & Family Health Insurance

Also known as “Obamacare plans”, this type of major medical insurance meets the ACA’s minimum essential coverage requirements. These plans are eligible for lower premiums through government subsidies. See if you qualify.

BarHealthTM for Solo Practitioners

Designed specifically for solo-practicing attorneys and their dependents, BarHealthTM harnesses the size and scale of membership to bring you savings. If you are a 1099 solo practitioner, start here.

Non-ACA Health Insurance*

Also known as “short-term health insurance”, non-ACA plans can be an affordable alternative for those who are in good health and don’t need coverage for maternity, mental health, substance abuse, or preexisting conditions. There is no designated enrollment period for these plans; you can apply at any time.

Still have questions?

Our team of licensed Benefits Counselors are here to help. Schedule an appointment so you can get your questions answered.

FAQs

Top Questions

What are the important dates for enrolling in health coverage?

- November 1: Open Enrollment begins for coverage that will become effective January 1.

- December 15: Last day to enroll for coverage that will become effective January 1.

- January 1: Coverage begins for those who enroll by December 15.

- January 15: Open enrollment ends. (If you enroll between December 16 and January 15, your coverage will begin February 1.)

If you miss the Open Enrollment period, you might still be able to apply for ACA-compliant health insurance if you experience a Qualifying Life Event (QLE) and qualify for a Special Enrollment Period. You can also apply for non-ACA health insurance (aka “short-term health”) at any time during the year.

How is this private insurance exchange different than healthcare.gov or other websites?

The Private Insurance Exchange provides you with the best possible pricing and allows you to shop and compare all of the carriers in the private market at once. Additionally, you have access to the assistance of a licensed Benefits Counselor that has your individual needs in mind. Our benefit counselors are committed to unbiased representation of all carriers and plan options. You are also able to enroll in other exclusive benefits such as supplemental health, telehealth, dental, vision, disability, etc. at the same time as your medical enrollment. This creates a one-stop-shop for all of your benefit needs. Your benefit elections are maintained in your personal account where you are able to log back in, view your benefits at any time during the year, and renew for the following year.

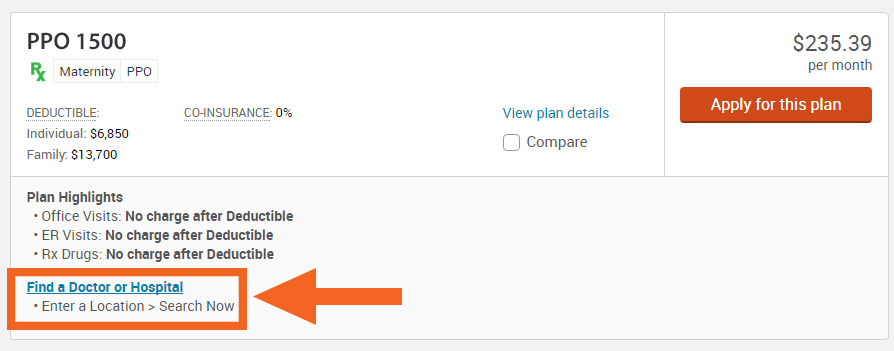

How do I look up my doctors?

Inside the exchange there is a provider search link next to each plan description and includes instructions of how to search the network. See below for an example of where it is located:

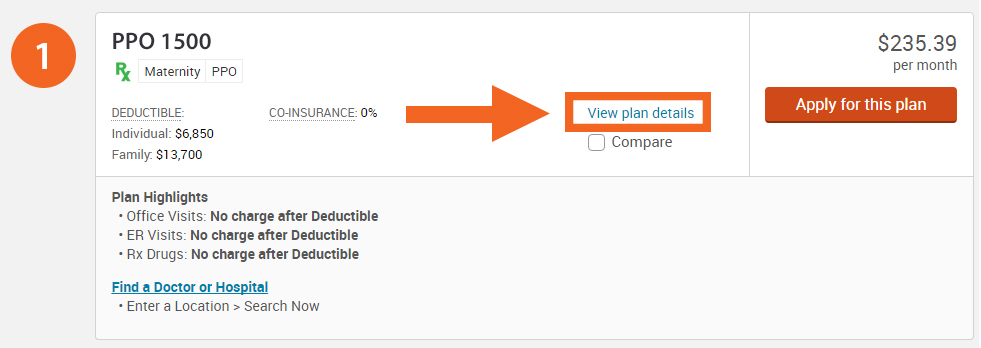

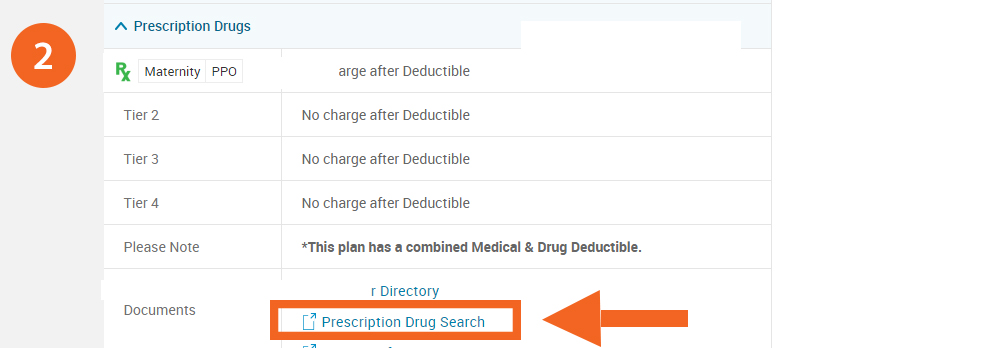

How do I know if my prescription is covered?

When you are shopping, select “View Plan Details”

Next, scroll down to the “Prescription Drug” section and select “Prescription Drug Search”

If my employer offers coverage am I able to enroll in a plan through this Insurance exchange?

Yes, you are able to enroll in an individual policy on the private exchange if your employer offers coverage however, because your employer offers coverage you are not eligible for a subsidy on the public exchanges.

If I have a claim issue who do I contact?

You will want to call the number on the back of your insurance ID card. All of the carriers have a designated claims department that will be able review any claims that a provider has submitted and explain the charges. If you have created a member log in with the insurance carrier you should also be able to access your claims online through the carrier website listed on your card.

How do I update or change my billing information for my health insurance?

To change or update your health insurance billing information you may contact the carrier’s billing department by calling the number on the back of your ID card. If you have created a member log in with the insurance carrier you may also be able to change your billing online through the carrier website listed on your card.

How do I change my address?

To change your address with your health insurance carrier information you may call the number on the back of your ID card. If you have created a member log in with the insurance carrier you may also be able to change your address online through the carrier website listed on your card.

Applying

How long do I have before I need to apply?

Please try to enroll as soon as possible as carriers are extremely backed up due to all policies being issued and renewing on the same date. Please note that if your deadline occurs on a week end you should submit your application to us by noon on the Friday before or if it occurs on a week day please submit before noon on day prior to the final day to ensure that the application is processed and you receive your requested issue date.

What information do I need to enroll?

For all family members that will be included in coverage you will need the dates of birth, social security numbers and premium payment. All carriers require that the initial premium payment is submitted upon applying. A carrier will not accept an application that does not have payment.

Am I able to enroll my dependents if I waive coverage due to having other coverage?

Yes, the Private Insurance Exchange is available to members and their dependents. Spouses and children may enroll even if the member waives the coverage.

Costs & Savings

Do I have to meet my deductible before I pay a copay?

Most services where a co-pay is noted the service is covered before you meet your deductible and the deductible is waived. There may be a few exceptions where you will have to meet a deductible prior to your copays. For example, for certain Rx tiers you may have a separate Rx deductible prior to paying a copay. In these cases, you pay up to the Rx deductible before the copays apply. You will want to review the SBC for full coverage details.

When does my deductible apply?

For any service not covered by a co-pay you pay up to your deductible at the “negotiated” (lower) rate – then you pay your coinsurance % (0, 10, 20 or 30 percent usually) until you reach a total cost (including deductible) which is called your out of pocket maximum – after that you are covered 100% for covered services for the balance of the year.

What does the term “Out of Pocket Maximum” refer to?

OOPM is the most that you pay for covered services before the carrier covers at 100%. The OOPM includes the deductible, copays, coinsurance and Rx.

Networks

PPO

Can receive care from any doctor you choose, no referral for specialty care (except UHC FL), may use out-of-network doctors – but may have to pay addition fees. PPO plans typically have higher monthly premium.

POS

Very similar to a PPO. Biggest difference is the contract between the insurance carrier and healthcare providers.

HMO

Must pre-select an approved Primary Care Physician, referrals are needed and for most plans there are no out of network benefits except for qualifying emergencies. HMO plans typically have lower monthly premiums.

EPO

Hybrid network that has limitations that vary based on the carrier. In some instances, you would need to get referrals and may not have coverage for out-of-network. These plans typically have a lower monthly premium.

* Non-ACA/short-term health insurance is medically underwritten and does not cover preexisting conditions. The coverage does not meet ACA minimum essential requirements. Availability varies by state.

** Medi-Share is not insurance or an insurance policy nor is it offered through an insurance company. Whether anyone chooses to assist you with your medical bills will be totally voluntary, as no other member will be compelled by law to contribute toward your medical bills. As such, Medi-Share should never be considered to be insurance. Whether you receive any payments for medical expenses and whether or not Medi-Share continues to operate, you are always personally responsible for the payment of your own medical bills. Medi-Share is not subject to the regulatory requirements or consumer protections of your particular State’s Insurance Code or Statutes.